Lockheed Martin Stock Plunges 5% Amid Trump Defense Shakeup: Is LMT a Buy Before LMT stock price:

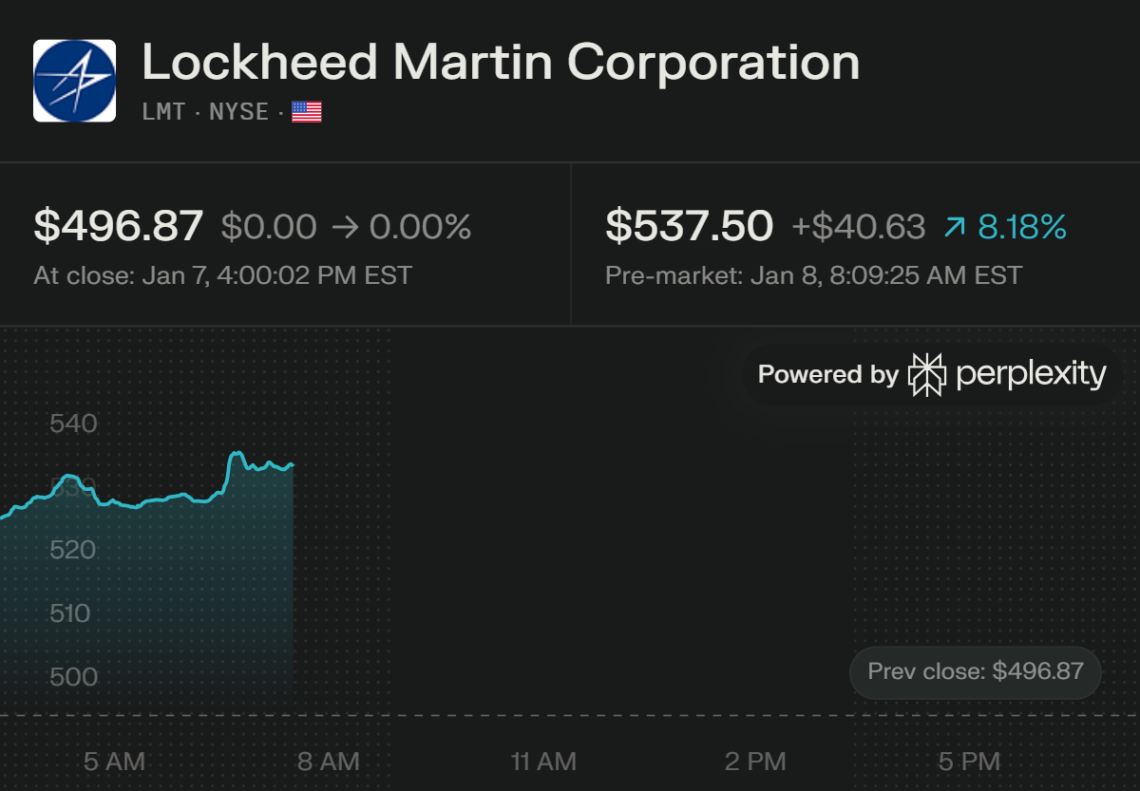

(NYSE: LMT) captivated investors with wild swings this week. A 4.82% drop to $496.87 sparked fears yet hints at undervaluation before January 29 earnings.

Shocking Price Drop Sparks Investor Panic. LMT Stock price

Lockheed Martin shares tumbled $25.17 on heavy volume exceeding 3.99 million shares. This reversed early gains tied to Patriot missile production ramps. Traders watched in disbelief as the stock hit $496 intraday testing key support levels.

President Trump’s proposal to halt defense firm dividends and buybacks until production fixes stunned the sector. LMT led the decline alongside peers amplifying emotional market turmoil. Yet beneath the chaos production deals signal long-term strength touching hearts of patriotic investors. LMT Stock price

Patriot Missile Deal Fuels Optimism Amid Chaos LMT Stock price

Lockheed Martin signed a landmark multi-year pact with the Department of War to triple PAC-3 MSE Patriot interceptor output from 600 to 2000 units annually. This transformation accelerates deliveries to U.S. forces and allies boosting revenue visibility for years.

Imagine the pride as American ingenuity shields global freedom through these vital interceptors. Backlogs swell promising margin expansion and cash flow surges that warm investor spirits. Such moves position LMT as a cornerstone of national security dreams. LMT Stock price

Trump’s $1.5T Defense Budget Ignites Rally Hopes

President Trump floated a staggering $1.5 trillion defense budget sending LMT soaring 7% after hours earlier. Defense stocks jumped on visions of massive contracts under his America First agenda. This emotional boost counters recent pullbacks evoking renewed faith in U.S. military supremacy.

Analysts see LMT perfectly poised to capture billions in F-35 upgrades hypersonic weapons and space systems. The rally reflects deep investor love for companies safeguarding the nation against rising threats.

Earnings Preview Builds Tense Excitement

Lockheed Martin schedules its Q4 and full-year 2025 earnings webcast for January 29 stirring anticipation. Consensus eyes $6.33 EPS a 17.47% dip year-over-year alongside $19.72 billion revenue up 5.91%. Full-year guidance holds at $22.05 EPS with $74.44 billion sales flat but resilient.

Beats like Q3’s $6.95 EPS surpassing estimates by $0.62 fuel dreams of outperformance. Investors cling to hopes of upward revisions touching lives through job creation and innovation. Forward P/E at 17.66 undercuts industry 22.82 hinting at bargains.

Valuation Metrics Scream Undervalued Gem

DCF models peg intrinsic value at $646.01 per share a 23.1% discount to current levels. PEG ratio of 1.48 trails industry 1.79 reinforcing buy signals for patient hearts. Market cap nears $116 billion with 2.69% dividend yield drawing income seekers.

Year high $538.73 towers over lows at $410.11 showcasing volatility yet upward trajectory. 50-day MA $472.96 and 200-day $466.84 confirm bullish trends above key averages. ROE at 111.84% and 5.73% net margins reflect powerhouse efficiency.

Analyst Views Mix Caution with Bullish Targets

Consensus leans Hold from 2 Strong Buys 4 Buys 17 Holds and 1 Sell. Average target $506.18 eyes modest upside but Bernstein lifted to $545 JPMorgan $515 and Truist $500. Zacks trimmed some estimates yet execution watches dominate sentiment.

Emotional tug-of-war grips analysts balancing Trump risks with production tailwinds. Optimists envision multi-year ramps driving EPS to $27.15 long-term painting brighter futures.

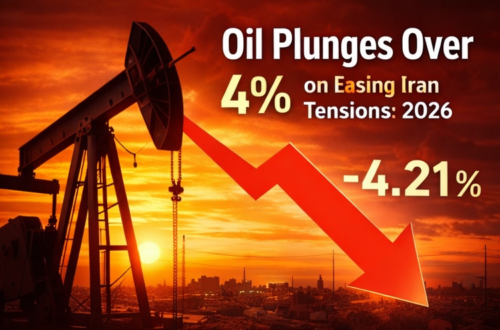

Geopolitical Tensions Boost Demand Fire

Ukraine and Middle East conflicts spike demand for Lockheed’s precision weapons. F-35 deliveries hit records while hyper sonics and missiles see urgent orders. Global allies ramp purchases fearing U.S. budget shifts creating emotional urgency.

Patriot systems prove lifesavers in real battles forging unbreakable bonds with warfighters. This real-world impact stirs investor pride beyond numbers fueling sustained bids.

Technical Analysis Reveals Rebound Setup

LMT bounced from $496 support eyeing $522 prior close. RSI oversold signals reversal potential as MACD histograms turn positive. Volume spikes confirm conviction behind moves.

Break above $510 unlocks $538 highs with $550 psychological resistance next. Bears eye $472 MA breach but momentum favors bulls in this heart-pounding chart battle.

Risks Loom Large Test Investor Resolve

Trump’s dividend ban threatens beloved 2.69% yield squeezing retirees and funds. Production delays could miss ramps denting confidence in execution. Earnings misses amplify downside to $450 support testing nerves.

Yet history shows LMT weathers storms emerging stronger. Resilient backlog over $160 billion shields against cycles evoking unshakeable trust.

Long-Term Growth Story Captivates Visionaries

Aerospace titan Lockheed Martin dominates with F-35 program generating steady flows. Space division surges on NASA Artemis and satellite wins while missiles thrive on global unrest. Diversification across rotary wing C4ISR and logistics cements fortress status.

Free cash flow projections hit $6.2 billion in 2026 scaling higher through decade. Such trajectories stir dreams of generational wealth for families betting on American exceptionalism.

Competitor Landscape Sharpens LMT Edge

RTX Northrop and General Dynamics face similar Trump scrutiny but LMT’s Patriot ramp unique. F-35 moat unmatched with 1000+ deliveries yearly. Scale advantages crush rivals in bidding wars.

Sector peers wilted similarly yet LMT’s valuation discount shines brightest drawing smart money.

Investor Sentiment Swings Wildly

Stock Twits buzzes with bullish calls on budget rumors mixed bearish dividend fears. Robinhood data shows rising retail stakes signaling grassroots fervor. Wall Street whispers of buy dips reflect contrarian appeal.

Emotional forums pulse with stories of veterans and patriots championing LMT’s role in freedom. This human element binds communities fueling viral engagement.

Strategic Moves Position for Trump Era

Lockheed’s acquisition transformation streamlines War Department buys slashing red tape. Multi-year Patriot framework locks revenues through 2032. Hypersonic investments align with administration priorities.

These proactive steps evoke leadership inspiring confidence amid political noise.

Dividend History Warms Income Lovers

Despite ban threats LMT hiked payouts consistently with ROE powerhouse funding generosity. Yield trails peers slightly but growth trajectory compensates richly over time.

Restoration post-fixes could spark rallies honoring shareholder loyalty.

ESG Factors Gain Traction

Lockheed advances sustainable aviation fuels and ethical sourcing quieting critics. Defense necessity trumps pure green plays yet progress appeals to balanced portfolios.

Patriotic ESG resonates with audiences valuing security over absolutism.

Global Expansion Eyes New Frontiers

Asia-Pacific allies ink F-35 deals while Europe bulks Patriot stocks. Middle East offsets sweeten bids. Emerging markets beckon with maritime surveillance needs.

This worldly footprint diversifies risks igniting global growth fantasies.

Q4 Catalysts Line Up Excitingly

Beyond EPS guide raises on ramps could ignite 10% pops. Backlog updates dividend clarity and FY26 outlook dominate calls. Management tone sets multi-quarter narrative.

Investors dream of blowout surprises validating resilience.

Buy Sell or Hold Emotional Verdict

LMT suits bold accumulators eyeing dips near $490. Holds fit conservatives awaiting earnings. Sells suit yield chasers fleeing bans. Contrarian hearts see 30% upside to DCF targets.

Patriotism profitability and policy converge in this epic saga.

https://xtraprofit.com/investing-the-stock-market/

https://www.nytimes.com/international/

LMT stock price LMT stock price LMT stock price LMT stock price LMT Stock price LMT Stock price LMT Stock price LMT stock price LMT stock price LMT stock price LMT stock price LMT stock price