Platinum Price Today: Hits All Time High on Supply Constraints 2025

Platinum Price Today: Hits All Time High on Supply Constraints 2025

Platinum has reached an all time high price as global supply shortages push the market into a new phase. Investors industry leaders and analysts are closely watching the metal as demand rises and available supply continues to shrink. This historic move is changing how people view platinum in the global economy.

Platinum is not just a precious metal. It plays a major role in clean energy cars medical tools and many industrial products. With supply under pressure and demand growing fast platinum prices are breaking records and drawing worldwide attention.

This article explains why platinum prices are rising what supply constraints mean for the market and how this trend could shape the future.

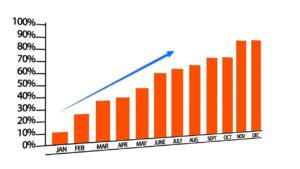

Platinum Price Reaches Historic Levels

Platinum prices surged to their highest level ever after months of steady gains. Market data shows strong buying interest from both investors and industries that rely on platinum for production.

This price jump did not happen overnight. It is the result of years of limited mining output rising industrial use and new demand from green technology sectors.

Many analysts believe this could be the start of a longer price rally rather than a short term spike.

What Is Driving Platinum Supply Constraints

The biggest reason behind platinum’s record high price is limited supply. Platinum is rare and hard to mine. Most of the world’s supply comes from only a few regions.

Key Causes of Supply Shortages

Mining disruptions

Major platinum producing countries have faced labor issues power shortages and weather related delays. These problems have slowed production and reduced exports.

Low investment in new mines

Platinum mining requires heavy investment and long development timelines. Many projects were delayed or canceled during past years of low prices.

Geographic concentration

A large share of global platinum comes from South Africa and Russia. Any disruption in these regions quickly affects global supply.

Declining ore quality

Existing mines are producing less platinum over time which makes extraction more costly and slower.

Together these factors have created a tight supply environment that is pushing prices higher.

Growing Demand Is Adding Pressure

While supply struggles demand for platinum continues to grow across several industries.

Automotive Industry

Platinum is a key material used in catalytic converters which help reduce vehicle emissions. Stricter environmental rules have increased platinum use in both gasoline and hybrid vehicles.

Clean Energy and Hydrogen Technology

Platinum plays a major role in hydrogen fuel cells and renewable energy systems. As countries invest in clean energy platinum demand continues to rise.

Jewelry Market

Platinum remains a popular choice for fine jewelry due to its strength and shine. Demand from Asia and North America has remained steady.

Investment Demand

Investors are turning to platinum as a hedge against inflation and market uncertainty. Platinum backed funds and physical purchases are growing.

How Platinum Compares to Gold and Silver

Platinum often trades differently from gold and silver. While gold is seen as a safe haven platinum is more tied to industrial demand.

At current levels platinum has outperformed both gold and silver over recent months. Some analysts believe platinum is still undervalued compared to gold when supply and demand are considered.

This comparison has drawn new interest from traders looking for value in the precious metals market.

Impact on Global Markets

The rise in platinum prices is affecting many areas of the global economy.

Manufacturing Costs

Industries that rely on platinum face higher production costs. This could lead to higher prices for vehicles electronics and clean energy equipment.

Inflation Concerns

Rising metal prices can add to inflation pressure especially in manufacturing heavy economies.

Trade Balances

Platinum exporting countries may benefit from higher revenues while importing nations could see higher costs.

What This Means for Investors

Platinum’s all time high has changed investor sentiment. Some see platinum as a strong long term investment while others urge caution after such a sharp rise.

Reasons Investors Are Interested

Limited supply supports higher prices

Growing industrial demand

Strong role in clean energy transition

Portfolio diversification benefits

Risks to Watch

Price volatility

Economic slowdowns that reduce demand

Possible future supply improvements

Experts suggest investors focus on long term trends rather than short term price moves.

Could Prices Go Even Higher (Platinum price today)

Many market analysts believe platinum prices could remain strong if supply constraints continue.

Future price movement will depend on several factors.

Mining recovery in key regions

Growth in electric and hydrogen vehicles

Global economic conditions

Government policies on emissions

If supply fails to keep up with demand platinum may set new records in the coming years.

Platinum’s Role in the Clean Energy Future

One of the most important drivers of platinum demand is the global shift toward clean energy.

Platinum is essential in hydrogen fuel cells which are seen as a key solution for reducing carbon emissions. Governments and companies are investing heavily in hydrogen projects.

This trend supports long term demand and strengthens platinum’s position in the global economy.

Expert Opinions on the Platinum Market

Market experts agree that platinum is entering a new phase.

Some believe the metal has been undervalued for years and is now catching up. Others warn that high prices may attract new supply in the long run.

Still most analysts see platinum as a critical material for the future especially in green technology and industrial use.

What Happens Next for Platinum

The platinum market is likely to remain active and closely watched.

Short term price swings are possible but long term trends point toward steady demand. Supply challenges are not expected to disappear quickly.

As industries evolve and clean energy expands platinum’s importance will likely grow.

Frequently Asked Questions

Why did platinum hit an all time high

Platinum prices rose due to limited supply growing industrial demand and increased investor interest.

Is platinum a good investment now

Platinum offers long term potential but investors should consider market risks and volatility.

How does platinum differ from gold

Platinum is more tied to industrial demand while gold is mainly a safe haven asset.

Will platinum prices fall soon

Prices may fluctuate but strong demand and supply constraints support higher levels.

Final Thoughts

Platinum hitting an all time high marks a major moment in the precious metals market. Supply constraints rising demand and the clean energy transition are reshaping platinum’s future.

For investors industries and policymakers platinum is no longer just a niche metal. It is a key player in the global economy.

Continue here: https://xtraprofit.com/

https://xtraprofit.com/bitcoin-price-87000-2025-santa-rally-bitcoin-crash/#respond

https://xtraprofit.com/blue-owl-buy-200-million/

https://xtraprofit.com/investing-the-stock-market-the-complete-beginners-guide/

https://xtraprofit.com/meta-plans-major-cutbacks-to-metaverse-division-as-ai-investments-intensify/

As the world moves toward cleaner technology platinum’s value and importance are likely to remain strong.

Platinum price today

#Platinum price today #Platinum price today #Platinum price today #US #Platinum price today

One comment on “Platinum Price Today: Hits All Time High on Supply Constraints shocking 2025 ”