China condemns US Venezuela action after U.S. forces carried out a military operation against President Nicolás Maduro, triggering global concern.

China has strongly condemned the US Venezuela action, describing it as a “hegemonic act” that violates international law and infringes on Venezuela’s sovereignty. Beijing’s response comes after U.S. forces carried out a military operation against Venezuela, including intense strikes and the capture of President Nicolás Maduro, which has triggered global concern and shifting geopolitical dynamics.

Although China has condemned the U.S. operation forcefully, it has not issued direct military or economic retaliation. Analysts say this cautious stance is likely intended to maintain stable trade with the United States — a key commercial partner — while signaling firm diplomatic disapproval.

China condemns US Venezuela action: Official Response

China’s Foreign Ministry stated it was “deeply shocked” and “strongly condemns the U.S.’s blatant use of force against a sovereign state and action against its president,” asserting that such actions seriously violate international law and Venezuela’s sovereignty and threaten peace and security in the region.

Beijing has repeatedly urged the United States to:

-

Abide by international law and the United Nations Charter

-

Cease actions that infringe on other nations’ sovereignty

-

Stop coercive practices and prioritize dialogue

In statements at the United Nations Security Council, China also called for the immediate release of President Maduro and his wife, describing the U.S. strike and capture as illegal and destabilizing.

Historical Context: China’s Role in Venezuela

China has been Venezuela’s largest energy partner since agreements signed under President Hugo Chávez in the mid‑2000s. Venezuelan oil exports backed Chinese loans and helped Beijing secure a stable crude supply, with Chinese companies investing billions in infrastructure and long‑term energy projects.

Beijing’s response to the China condemns US Venezuela action reflects these long‑standing economic ties and a strategic interest in defending sovereign rights in Latin America, even as it manages complex relations with Washington.

Markets Watch Strategic Impacts

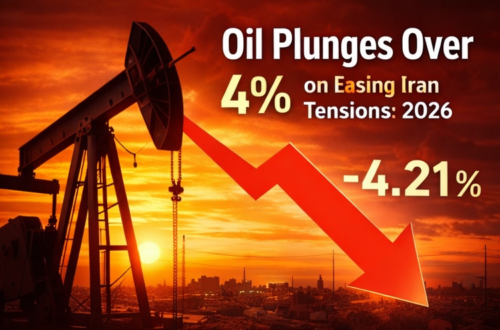

Energy Sector and Oil Trade

Markets are evaluating how the U.S. takeover of Venezuelan oil export revenues might affect global energy flows. The Trump administration has allowed China to continue purchasing Venezuelan oil but only at fair market prices, rather than the steep discounts Venezuela previously offered under Maduro. This could reduce the volume of Venezuelan crude heading to China and reshape supply chains.

Additionally, changes to revenue routing could affect China’s creditor status on Venezuela’s large foreign debt, creating challenges for future negotiations and potentially reducing Beijing’s leverage in restructuring deals.

U.S.|China Relations and Strategic Balance

While China condemned the U.S. action, it has not escalated to direct retaliation such as sanctions or military posturing. Experts believe Beijing’s balanced approach aims to:

-

Preserve stable trade and economic ties with the U.S.

-

Signal opposition to unilateral military actions abroad

-

Maintain China’s influence in Latin America without triggering a wider geopolitical confrontation

China’s condemnation echoes broader concerns among Global South countries about unilateral interventions and respect for sovereign decision‑making.

Global Diplomatic Echoes : China condemns US Venezuela action

Beijing’s stance aligns with reactions from other nations critical of the U.S. operation. For example, Brazil’s President Luiz Inácio Lula da Silva has also condemned the strikes as infringing on sovereignty, emphasizing adherence to international norms.

These worldwide responses highlight a growing divide in perspectives on military intervention and underscore concerns about the erosion of accepted international legal frameworks following the China condemns US Venezuela action statements from Beijing.

What Investors and Energy Markets Should Watch

Investors and energy market analysts are monitoring:

-

Potential short‑term volatility in crude pricing as geopolitical signals shift

-

Impact on long‑term contracts and energy investments involving China and Venezuelan partners

-

How China manages future purchases of Venezuelan oil under new market conditions

-

Broader implications for U.S.–China strategic competition in energy and finance

With China expressing strong diplomatic opposition but refraining from direct retaliation, markets may experience fluctuation — but analysts do not foresee an immediate breakdown in global energy trade.

China condemns US Venezuela action

Conclusion: China’s Strategic Response

The China condemns US Venezuela action declaration by Beijing underscores China’s defense of international law and sovereignty, reaction to U.S. use of force, and broader strategic posture toward foreign military interventions. Although the rhetoric is strong, China’s cautious, calibrated approach reflects both economic pragmatism and diplomatic signaling in an era of complex great‑power competition.

U.S. Signals on China

President Trump has downplayed the risk of the move straining U.S.-China relations, noting that Beijing will continue to access Venezuelan oil.

“We’ll be selling oil, probably at much larger doses,” Trump said.

Secretary of State Marco Rubio emphasized that U.S. policy aims to prevent adversaries, including China, from controlling Venezuelan energy. Analysts anticipate some short-term market uncertainty but no immediate disruption to existing Chinese oil investments.

Market Implications

Financial analysts warn investors to watch for:

-

Short-term U.S.-China tensions affecting energy trade.

-

Potential adjustments to Venezuelan oil contracts and pricing.

-

Increased volatility in global oil markets as investors react to political risk.

Despite geopolitical tensions, Chinese firms’ presence in Venezuela could provide continuity in oil supply, limiting immediate market disruptions.

Key Takeaways

-

China condemned the U.S. operation but avoided threats.

-

Venezuela’s oil agreements with China remain intact for now.

-

Markets may see temporary volatility due to U.S.-China strategic competition.

-

Investors should monitor energy sector updates closely, particularly crude pricing and policy signals.

Official & External Sources

Internal & External Links

-

Internal links:

XTRAPROFIT.com

⚖️ Disclaimer

This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult licensed advisors before trading in energy or geopolitical-sensitive assets. XTRAPROFIT.com